photo by wort.lu

While living in Japan as a foreign resident, you probably have many occasions to exchange money to transfer to or from overseas. You may receive living expenses sent from your parents while studying, or send money to your family in overseas while working for a company in Japan. When you make an international money transfer by using banks, the biggest disadvantage is expensive bank fees. For example if you use a Japanese bank to send money to overseas, you will have to pay nearly 10,000yen of bank fee as well as extra cost hidden in their exchange rate. However, a few years ago, TransferWise drastically changed the way of international money transfer by eliminating these high bank fees. So, how does TransferWise work?

TransferWise URL

What is TransferWise?

You may have heard of the name TransferWise as it was introduced in media as a totally new money transfer service all over the world. Its establishment is quite recent. The company was co-founded in 2011 by two Estonian citizens Taavet Hinrikus and Kristo Käärmann who were working in U.K. The service originally started from a personal arrangement between Hinrikus, who was receiving his wages in euros, and Käärmann who was paying his mortgage in euros in Estonia. They started privately exchanging their euros and pounds and putting currency in each other’s accounts to save bank fees. They thought there must be many other people like them whose currency needs match the others’.

Advantages of TransferWise

The biggest upsides of TransferWise are exchange rate without hidden costs and low transaction fee. When you transfer money internationally, banks charge fees such as transaction fee, related bank fee and currency exchange fee. In addition, your money is exchanged by using rates including markup that covers market fluctuations of the day. On the other hand, TransferWise charges only 1 to 1.5% of transaction fee (the fee varies by currency you wish to exchange) and also uses a mid-market rate which is very close to a real-time market rate. Accordingly, you eventually pay a lot less expenses compare to other banks. 90% of transactions are completed within 24hours to satisfy urgent needs of users. Getting started is easy and straightforward, you just need to sign up online to create an account. If you reside in Japan, you will be required to upload a copy of proof of My Number (My Number card, notice of My Number) as well as either of passport and driver license to open a new account.

Currently, TransferWise can send and receive:

Euro, Pounds Sterling, US Dollar, Australian Dollar, Swiss Franc, Canadian Dollar, Polish Złoty, Swedish Krona, Norwegian Krone, Danish Krone, Hungarian Forint, Czech Koruna, Bulgarian Lev, Romanian Leu, New Zealand Dollar, Japanese Yen, Brazilian Real, Singapore Dollar.

TransferWise can only send out:

Indian Rupee, Hong Kong Dollar, Malaysian Ringgit, Philippine Peso, Pakistani Rupee, Moroccan Dirham, Thai Baht, Emirati Dirham, Ukranian Hryvna, Indonesian Rupiah, Colombian Peso, Georgian Lari, Turkish Lira, Mexican Peso, Russian Rouble, South Korean Won, Chinese Yuan, Sri Lankan Rupee, Bangladeshi Taka, Vietnamese Dong.

How TransferWise works

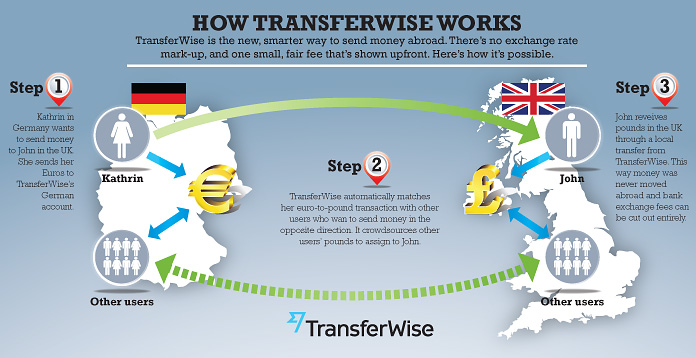

From the customer’s point of view, the service provided by TransferWise is not very different from other banks’ international money transfer services except for fees. A customer send a remittance with payee’s account detail, then the payee receive money in his bank account. What makes TransferWise differ from conventional money transfer is that there is no actual “international money transfer” involved during the course of transaction.

TransferWise is an online money transfer service which matches the currency flows by using a peer-to-peer system. Let’s say, A who is in Japan wants to exchange 100,000yen to pounds to transfer it to B who is in U.K. Then, A requests TransferWise for a money transfer and remit 100,000yen into TansferWise’s Japanese bank account. TransferWise automatically matches D who lives in U.K. and wants to send 100,000yen to C in Japan. That is, the 100,000yen which was paid into TransferWise’s account by A is diverted to the payment to C within Japan instead of being exchanged and transferred to U.K. Likewise, 100,000yen worth of pounds paid by D is diverted to the payment to B within U.K. This is how TransferWise eliminates bank fees to deliver the funds to clients with a little amount of transaction fee.

Tips to use TransferWise

Transfers into bank account only

TransferWise only send money to payee’s bank account in the destination country. There is no cash pick up service.

Maximum amount to send

The maximum Japanese Yen amount to send is 1,000,000yen per transaction. Other currencies are also capped at similar amount.

Best option when transferring small amount

TransferWise offers the best deal when transferring rather small amount of 300,000 – 500,000yen. Maximum amount of Japanese Yes to be sent is 1,000,000yen, but you may find a better deal with other currency broker if sending more than 500,000yen.

Japanese banks charge fee for receiving funds

Unfortunately, Japanese banks charge 2,500 – 4,000yen of transaction fee to receive funds from overseas. If you are sending money from overseas into Japanese bank account, take into consideration this receiving cost to decide if you want to use TransferWise.

Bye bye bank charges

In March this year, TransferWise launched its service in Japanese Yen. There must be quite a few foreign residents who were already using TransferWise to send and receive other currencies. But now they are transferring Japanese, so sending and receiving a small amount of Japanese Yen has become far easier than before. This is a great news for people who had to send a large sum of money at once to save bank fees.

Related Article:

The Indispensable Inkan: A guide to the Japanese seal

Guidance for foreigner to open a bank account in Japan

Read this before your trip to Japan! How to use foreign credit cards at Japanese ATMs

No bank account required! Sending money to bank account

How to transfer funds to Japan other than bank transfer

Japan Post Bank’s online banking: How to make a payment in Yucho Direct

No Japanese required! 2 Japanese banks providing online banking service in English

Had enough of transaction fees? Send money from your credit card through PayPal

Bank transfer bounced back? How to send money into Japan Bank Post account

Frequent payment from ATM? Add payee or get payee card

Every transaction, fees apply: Bank charges in Japan

Want to save bank fees? Use Japan Post Bank

Japan is still a cash society! Money exchanger in Tokyo

Prepare cash before visiting tourist hot spots! Money exchanger in Osaka