photo by puretravel.com

Foreign workers who are not registered with the Employee’s Pension Insurance system (the EPI system) are covered by the National Pension system (the NP system) only, and there are many of those in Japan. If you eventually decide to return home without receiving any benefits from the NP system, don’t you wish to recover a part of contributions you have paid? If so, you may want to consider taking the lump-sum withdrawal payment of the NP system. Let’s have a look at details.

The lump-sum withdrawal payments of the NP system

First of all, who enrolls in the NP system? Sole proprietors such as shop owners, tradesmen, freelance designers, casual workers, or employees of small businesses which is not registered with the EPI system (this is not permitted, however there are quite a few businesses running without the EPI coverage in reality) are solely covered by the NP system. All registered residents of Japan aged 20 to 59 years must enroll in the NP system no matter of your nationality. Therefore, to prevent you from wasting all your contributions you have paid, foreign residents, who have coverage periods under the NP system for six months or more, can claim the lump-sum withdrawal payments after they depart from Japan permanently. The EPI system offers a similar lump-sum payment, but there are a few differences in calculation and other details.

Conditions of the Lump-sum withdrawal payments under the NP system

To receive your lump-sum withdrawal payments, you must firstly meet all of the following conditions:

- You have coverage periods under the NP system for six months or more (exemption periods to be adjusted, if any).

- You are not a Japanese citizen

- You have never been entitled to any Japanese public pension, including the Disability Allowance

- You are not resident in Japan and not covered by the National Health Insurance

In addition, you need to file your application with Japan Pension Service within two years after your Basic Resident Register in Japan is canceled. The procedures might take some time as an application can be made only outside of Japan. Also, in order to meet the condition No.4, you must lodge a moving-out notice at a municipal office in your area. Make sure to cancel your Basic resident Register at your municipal office before leaving Japan.

The payment amount you may receive

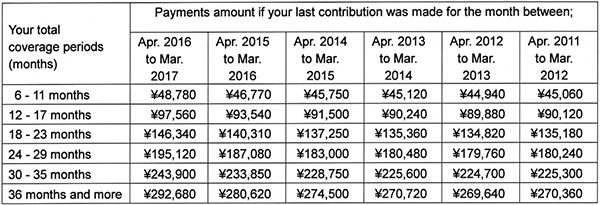

Unlike the payment calculation under the NPI system, you can work out the amount you will receive by using your coverage period and the last month you paid the contribution. Please refer to the tables below (the bottom table is English translation of the top table).

There is no need to file a tax return for the lump-sum withdrawal payments of the NP system. An applicable amount in the table will be exchanged and transferred in your nominated bank account. Note that the amount will be calculated based on your coverage period up to 36months. The coverage period over 36months will be disregarded no matter how long you were covered by the NP system.

Required documents

You must submit the following documents to apply for the lump-sum withdrawal payments of the NP system.

Application form

Forms in multiple languages can be downloaded from Japan Pension Service website.

Photocopy of your passport

Page(s) showing date of your final departure from Japan, your name, date of birth, nationality, signature and resident status, e.g., instructor, engineer or trainee.

Your bank account detail

Documents issued by your bank name of the bank, name and address of the bank branch office, your account number and anything to show the account holder is the claimant (yourself).

Your Pension Handbook

Make sure to take your pension handbook with you when you leave Japan.

You will need to send above documents after you leave Japan. The application from with detailed instruction can be downloaded Japan Pension Service website. Even a mailing label is attached on the form. Once your application is granted, your lump-sum withdrawal payments after tax will be internationally transferred into your bank account at a rate at the time.

About the bilateral Social Security Agreement

Importantly, you should carefully decide whether to apply for the lump-sum withdrawal payments if your country is one of the partner countries of Japan under the bilateral Social Security Agreement. If you have valid coverage period under Japanese system and agreement country’s system, you may be entitled to totalization benefits, subject to qualifying conditions. Let’s have a look a case of a U.S. citizen, who had paid contributions under U.S. system for 3 years, paid contributions to the NP system for 6 years after arriving Japan. The person needs to participate U.S. system for one more year to meet the 10 years minimum coverage conditions under U.S. system, only if he did not use his coverage period in Japan to receive the lump-sum withdrawal payments. On the other hand, if the person receive the lump-sum withdrawal payments, he will be required to pay contributions for another 7 years to meet the 10 years minimum coverage conditions under U.S. system. That is, “totalization benefits” means combining valid coverage periods in two countries to examine an entitlement under each country’s social security system. As for the previously mentioned U.S. citizen, if he does not receive the lump-sum payment from Japan, and participated U.S. system for another 16years after returning home, he will fulfill Japan’s 25years minimum coverage condition as well as the 10years condition under U.S. system. The person will be entitled to receive the old-age basic pension from Japanese government in addition to his U.S. pensions. The amount of pension benefits from Japan will be little as it is calculated based on his 72months coverage period. However, it may be a better deal than just receiving the lump-sum withdrawal payments as he will be entitled to keep receiving that amount every year after he reaches 65 years of age. Therefore, taking an instant money or waiting recurring little benefits in the future is up to you.

Partner countries of the bilateral Social Security Agreement of Japan: Germany, U.S.A, Belgium, France, Canada, Australia, the Netherlands, Czech Republic, Spain, Ireland, Brazil, Switzerland, Hungary, India (not in effect), Luxenberg (not in effect), Philippines (not in effect)

Summary

Unlike the EPI system which your company pays half of your contribution amounts, you are required to pay full amount of the contributions by yourself. The burden will be doubled if you have family as there is no dependent exemption under the NP system. If you are entitled to the lump-sum withdrawal payments of the NP system, fully utilize it to maximize your funds.

Related Article:

The National Pension System: Participation is mandatory for all registered residents

Studying in Japan for over a year? Apply for Special Payment System for Students

Attention, short term students: contribution postponement system of NPS

So you lost your job, apply for special exemption of NPS

Accessing pension earlier: Lump-sum withdrawal payments of the EPI system

National Pension: Procedures to update residential address when moving house

No more dual pension contribution: International Social Security Agreement and Certificate of Coverage

Changing jobs? You may have to switch pension systems

What would happen if a foreign national resident neglect to pay pension contributions?

Before a crossroad in life, check if you have Pension Handbook

SAYONARA Nippon, 5 things to do before you bid a farewell to Japan

One thought on “Returning home? The Lump-sum withdrawal payments of the NP system”